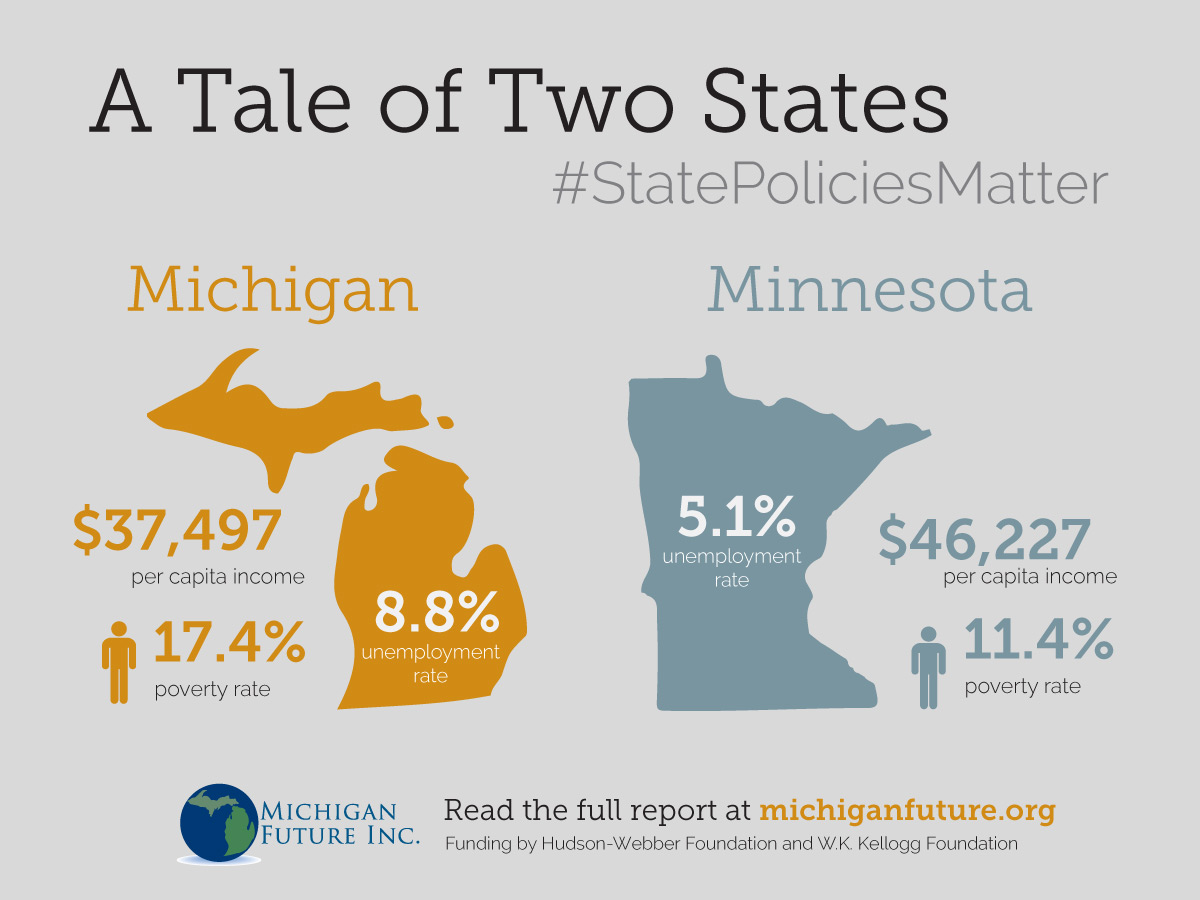

Michigan Future’s latest report looks at Minnesota, the most prosperous state in the region with the lowest unemployment rate, and the public policies that have helped it achieve that status.

Below we will release shareable graphics that demonstrate some of the staggering data uncovered in the report. Follow the links below to download the graphics to share on your organization’s or personal social media. As you share them, we encourage you to use the hashtag “#StatePoliciesMatter” to help spark conversation around Michigan Future’s latest report.

If you haven’t done so read the full State Policies Matter report here.

INFOGRAPHIC #1: Right-click on the image and select “Save Image As.”  INFOGRAPHIC #2: Right-click on the image and select “Save Image As.”

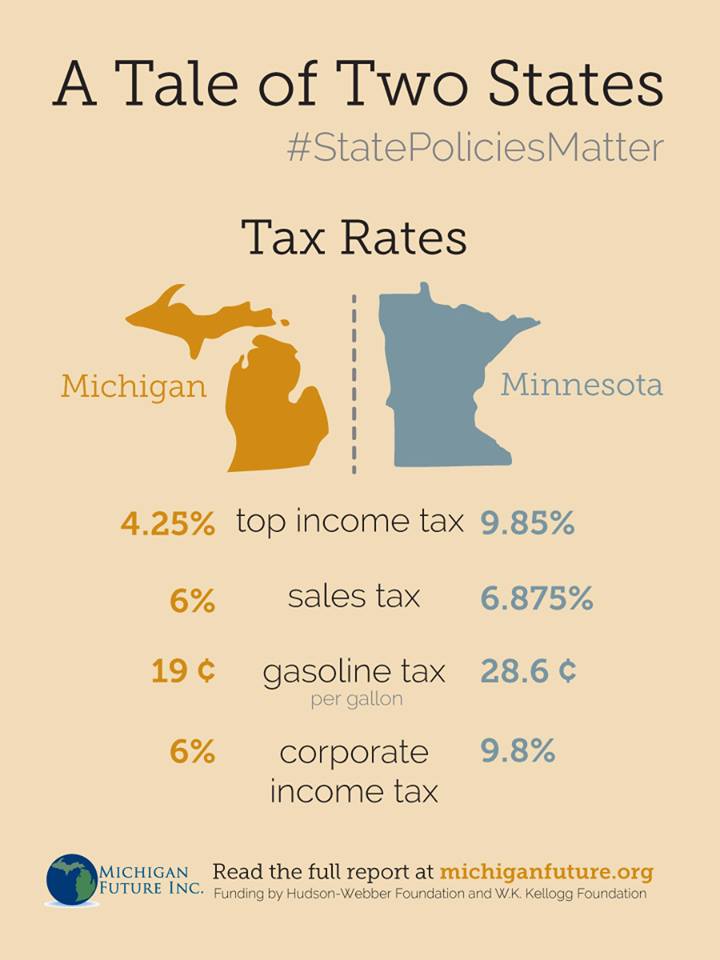

INFOGRAPHIC #2: Right-click on the image and select “Save Image As.”

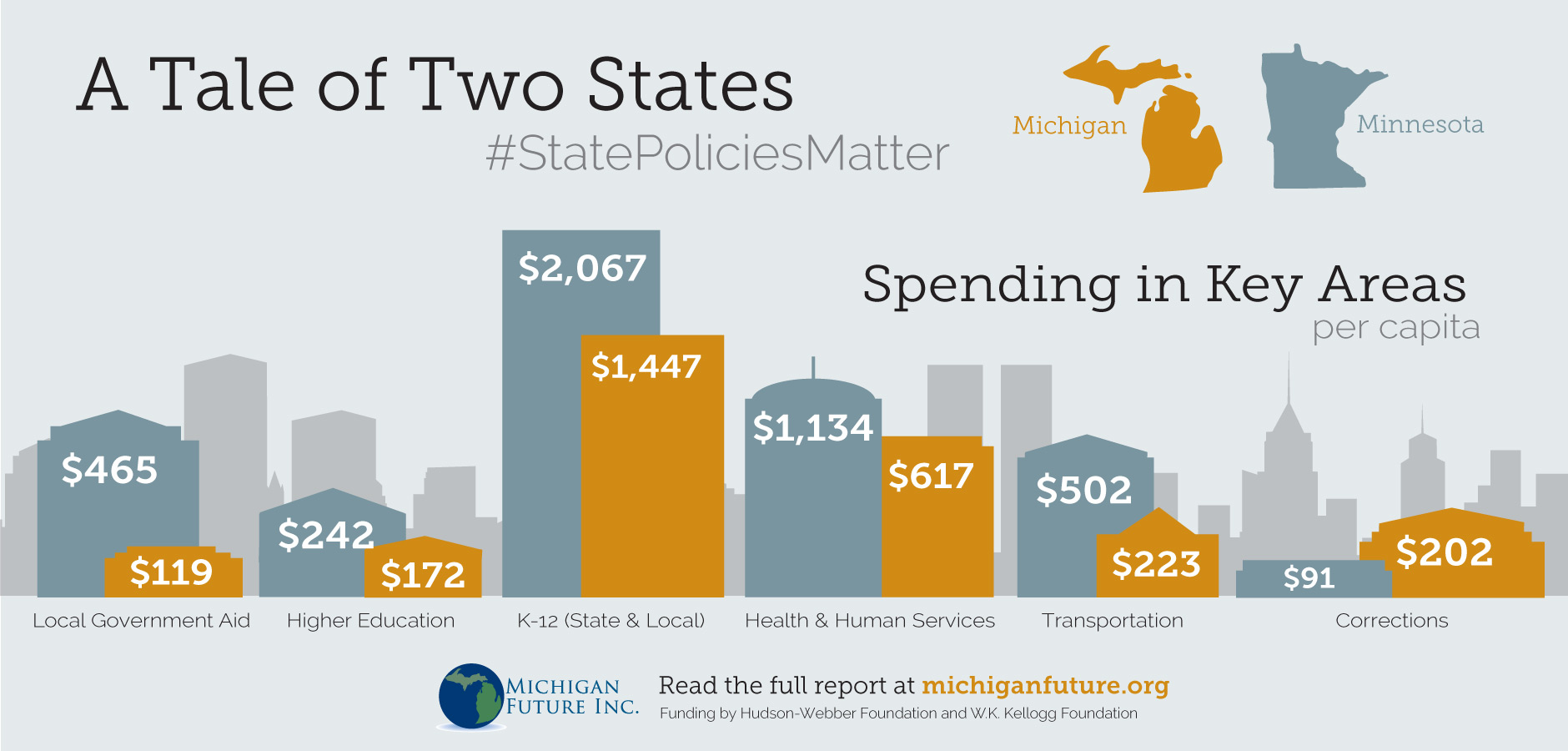

INFOGRAPHIC #3: Right-click on the image and select “Save Image As.”